Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

When to File Form 2290 for the 2023-2024 Tax Period?

Usually, Form 2290 must be filed by the last day of the month following the month of the first use on public highways. If any due date falls on a Saturday, Sunday or legal holiday, then Form 2290 must be filed by the next business day.

The current tax period begins from July 1, 2023, to June 30, 2023. August 31, 2023, will be the deadline for the vehicles that are first used in July for the 2023-2024 tax period. Having vehicles with different first used month? Check your Form 2290 due date here.

Never wait for your deadline. Get your schedule 1 immediately. File 2023-2024 Form 2290 Now with a trusted provider.

How to File 2023-2024 Form 2290?

Electronic filing is mandated for each return that is reporting more than 25 vehicles. But still, the IRS encourages the electronic filing for filers who want the quicker processing of their 2290 return. Form 2290 Schedule 1 will be available immediately after the IRS accepts your return.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-instructions/ to know more about each line of Form 2290 in detail.

Overcome the hassles in the paper filing, by switching to electronic filing. Get your 2290 Schedule 1 for 2023-2024 in minutes.

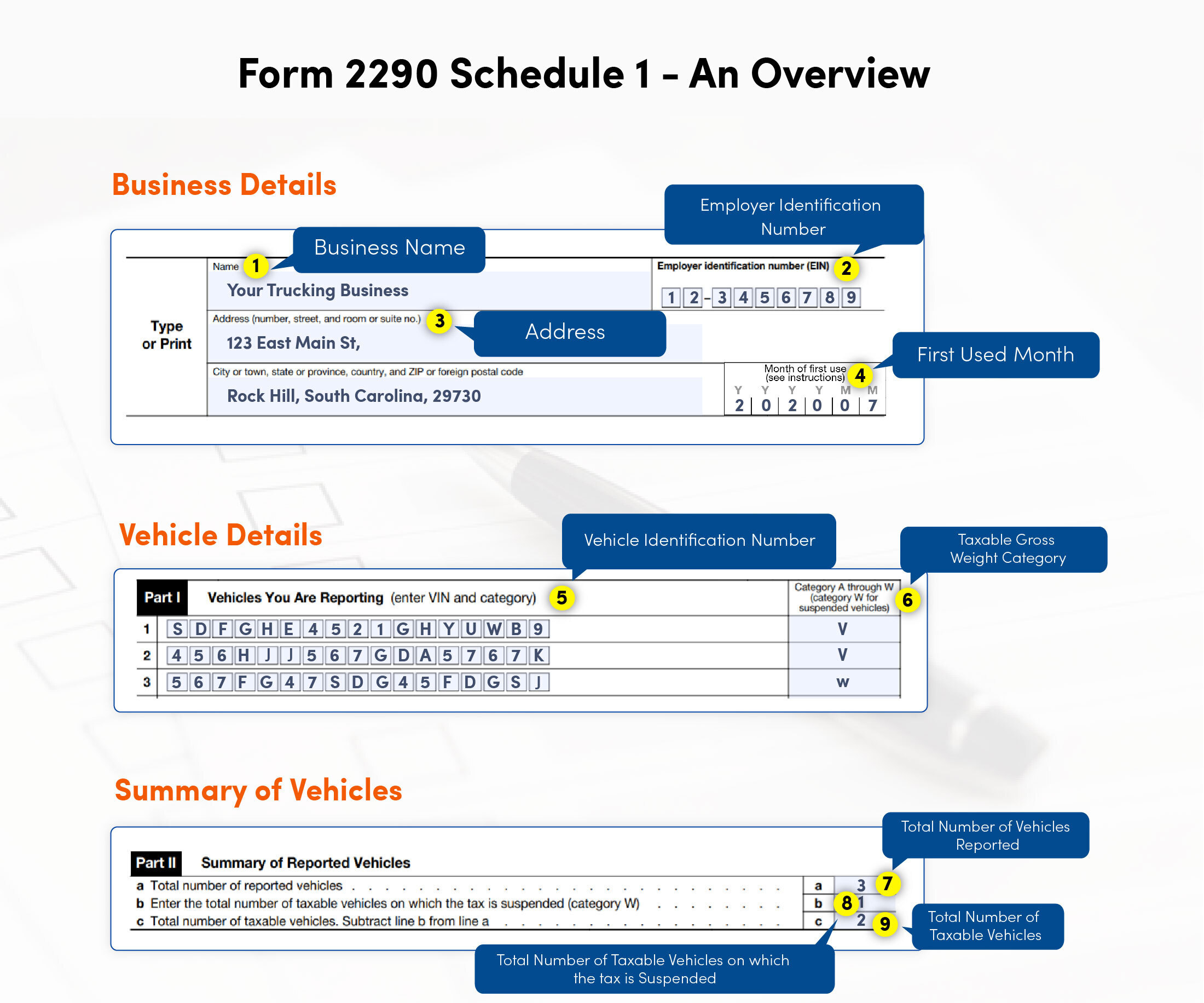

Prepare yourself to file your 2023-2024 Form 2290 Electronically

-

Gather the basic information required for filing

- EIN of your business

- VIN and Taxable Gross Weight each vehicle

-

Choose a preferred payment option and pay your HVUT

- Electronic Funds Withdrawal (can authorize as a part of your e-file process)

- Electronic Federal Tax Payment System (EFTPS)

- Check or Money Order

- Debit/Credit Card (Temporarily suspended by IRS)

You will receive your IRS e-file Watermarked Schedule 1 via email once IRS accepts your 2023-2024 2290 Form.

Visit https://www.expresstrucktax.com/hvut/e-file-form-2290-online/ for more information about filing Form 2290 electronically with the IRS using the market leader ExpressTruckTax.

Get Started Now file your 2023-2024 Form 2290!

How to E-file Form 2290 for 2023-2024 Tax Year?

Create a Free Account

Add your Business Details

Enter your First used Month and Add your Vehicle's Details

Choose your mode of TAX payment

Review Form Summary & Transmit it directly to the IRS

Get your schedule 1 instantly via your registered email.

You can also opt-in to receive your Schedule 1 directly to your address through our postal mail feature. You can even get a copy through fax or send a copy to the carrier that you are working for.

Visit https://www.expresstrucktax.com/hvut/form-2290-schedule-1/ to know more about Schedule 1.

Why should I choose ExpressTruckTax to file my 2023-2024 Form 2290?

- Leading IRS Authorized 2290 Provider

- Complete E-file Solution

- Get Schedule 1 in minutes

- Accurate Calculations

- 2290 Amendments

- Free VIN Corrections

- Free Retransmission of Rejected 2290

- Form 8849 (Schedule 6)

- Templates to Upload Multiple Vehicle Information

- Store/Retrieve Vehicle Information

- PrePay & Get 10% Off on your Filing

- Receive Schedule 1 via Fax or Postal Mail

- Flexible Pricing for CPAs

- Copy Data from Previous Return

Access all these features with a 100% U.S based customer support and access your returns from anywhere and anytime.

Having any queries related to Form 2290?

We are located and operating from Rock Hill, South Carolina providing our users with 100% expert assistance. Our team of support people is ready to assist you for any queries related to your 2290 filing. Reach us through 704.234.6005 or email your queries to support@expresstrucktax.com.